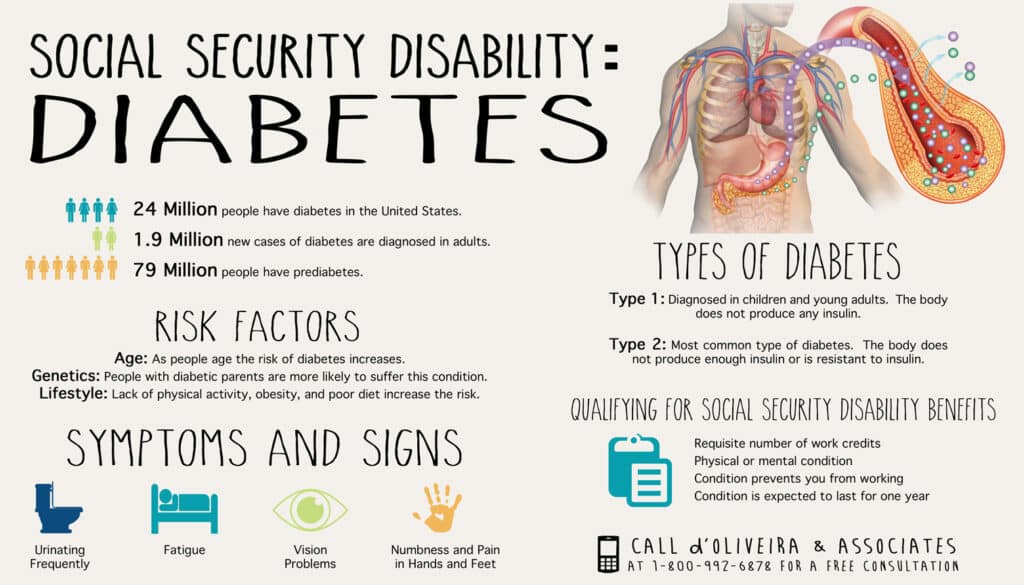

d’Oliveira & Associates has released a new infographic on diabetes and disability applications which details the essential qualifications people with this condition must meet in order to obtain benefits. Two important requirements that applicants must establish are that they have the required number of work credits and that their medical condition will prevent them from working for at least one year.

Diabetes is one condition that can be disabling in some circumstances. The Social Security Administration (SSA) categorizes diabetes as an endocrine disorder on its list of impairments. The SSA states that some people with this condition are unable to “achieve good control” of their blood sugar levels which can restrict their ability to work. Specifically, failure to “achieve good control” can result in hyperglycemia (too much sugar) or hypoglycemia (too little sugar) (i).

Hyperglycemia and hypoglycemia are incapacitating when their symptoms, like confusion, dizziness, and weakness, prevent a person from engaging in substantially gainful activity. Basically, when the symptoms of diabetes substantially disrupt a person’s ability to work and support himself or herself the SSA finds that the condition is disabling. If you are a diabetic who has been denied benefits, then you should contact the Social Security Disability lawyers at our Warwick, Rhode Island office.

Reports of Disability Over Payments

Many people find the application process difficult but according to a recent article from CNN Money a number of people are also experiencing difficulties after they have obtained benefits. Specifically, the article reported that the SSA has overpaid benefits and then demanded that the beneficiary refund the over payment. An audit by the Government Accountability Office (GAO) revealed that the SSA had made “$1.3 billion in over payments in just two years.” A representative of the GAO stated that the SSA has to “balance their resources between getting people off the rolls and getting people on the rolls.”

Read the story here: http://money.cnn.com/2013/10/29/pf/social-security-overpayments/

The article detailed the story of Elizabeth Siener who received such over payments. She began working in the summer of 2012 but still received benefits. She notified the SSA of this fact but the SSA stated that the benefits were for an underpayment in a previous year. The SSA then demanded a refund for the $40,000 in over payments. Consumer advocates and lawyers argue that the SSA should have to bear the cost of its own mistakes. One advocate said, “What is so frustrating is not just the fact that getting an over payment throws them into turmoil financially, for some of the people their main disability is anxiety and depression so this renders them almost incapable of working.”

If you are a diabetic who has been receiving benefits and recently returned to work, you should alert the SSA of this change. If you have concerns about the benefits you are receiving, you can contact your local Social Security Office or talk to the lawyer who helped you secured benefits.

The experienced Social Security Disability lawyers at d’Oliveira & Associates are dedicated to providing client-centered legal services to Rhode Island residents. We can help you establish your case to the SSA and we will fight for any past due benefits you are entitled to receive. For people in the Warwick, Rhode Island area we have an office conveniently located near Interstate 95. We also have fourteen other locations throughout Rhode Island and southeastern Massachusetts. Feel free to call our law firm anytime at 1-(508) 625-9765, or fill out an online contact form for a free legal consultation.

d’Oliveira & Associates

88F Jefferson Blvd.,

Warwick, RI02888

Phone: (401) 490-6907

Sources:

- (i) Social Security Administration, Endocrine Disorders.

http://www.ssa.gov/disability/professionals/bluebook/9.00-Endocrine-Adult.htm